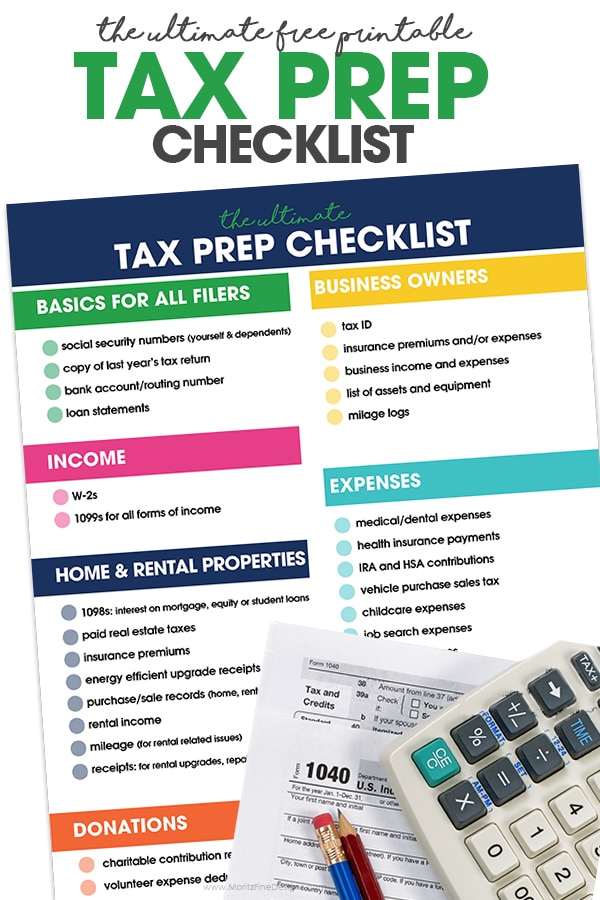

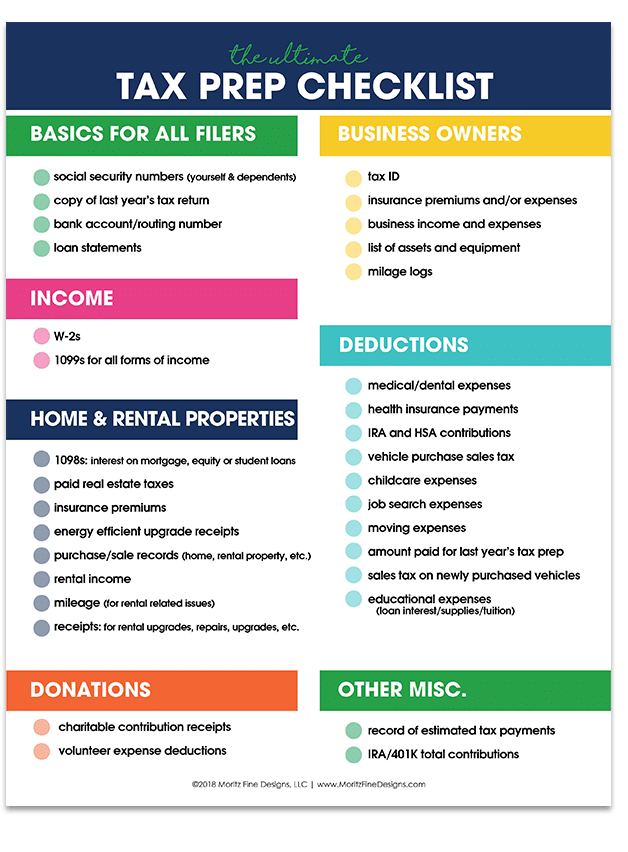

The Ultimate Income Tax Prep Checklist

Every year you’ll hear people moaning and groaning about how it’s tax season again. Nobody likes having to pay money on their income, and they hate paying money to find out how much they overpaid even more! Despite what you may have heard, tax season doesn’t have to be a yearly struggle! Knowing what you need to prepare can make tax season a breeze!

PREPARING YOUR TAX DOCUMENTS

The most important thing you’ll need to prepare for tax season is all your tax documents. This is pretty much just your W-2 for most people, but can also be many 1099s for specific types or earnings or for self-employment. You will need to get these from your employer. Most employers send them out on a schedule just before tax time. A better time estimate from your employer can be a big help in planning down the road.

DEDUCTIONS

Another thing you’ll want to be sure you have is any receipts for tax-deductible donations you’ve made throughout the year. Depending on your situation, this could save you a fair amount by lowering your taxable income! Many other things can help reduce your tax liability, but your accountant (or tax software) will help you figure out the best thing for your situation. One thing people seem to get confused about with tax deductions is they are NOT just getting free money back! A deduction only lowers your total taxable income by that amount. It may sound a little confusing, but it’s worth it every penny counts!

SHOULD YOU USE AN ACCOUNTANT?

When it comes to preparing your taxes, you have two options. You can go to an accountant and have them done professionally, or do them yourself. If you choose to use an accountant, there are plenty of reputable firms out there. You may have heard of a few, as they tend to boost their advertising around tax season. Just be sure to do your research about pricing and services to find what’s best for you.

Filing Online

If you are not going to an accountant, preparing your taxes yourself is not as daunting a task as it may seem! In fact, it is easier than ever with the advancements in tax preparation software and e-file systems.

Filing For Free

If your income is below $66,000, you qualify for free tax preparation software from the IRS, saving some money over an accountant! One thing to be aware of though, typically this only covers your federal returns. This means you may need to use other software to complete your state taxes.

Filing If You are Self-Employed

I mentioned self-employment earlier, and I need to jump back to that for a moment. If you are self-employed, it is unlikely free tools will work for you due to your 1099 tax forms. This also will make it more expensive to file with an accountant as well, so this is something to be aware of. Self-employment also means you’re responsible for your tax contributions, and you most likely have to make quarterly payments to keep up to date on your tax liabilities. Self-employment can also mean some of your business expenses can be deducted from your income, so be sure to keep detailed notes of your expenses and all those receipts. Personally, because I am self-employed, I use home & business tax software and it has worked really well for us.

THE KEY TO EASY TAX PREPARATION: GET ORGANIZED

Throughout the year, the most important thing for taxes is to stay organized! If you’ve been keeping track of all your documents and keeping things in order, you’ll have no problem getting it all done. If you struggle with keeping your paper clutter organized, you can read more about how to manage it all here! Once you have a system in place for sorting all your tax paperwork, it’ll be no problem to keep everything in one place for next year. This can make all your tax headaches go away in an instant, so it is certainly worth doing!

Taxes can be intimidating for a lot of people, but they’re easier than they seem if you’re prepared. Use this Tax Prep Checklist* (click the link below to download) to get everything ready to go, and you’ll be cruising through like a pro!

*DISCLAIMER: The items on this list are documents and data elements that are needed to be compiled for completing your taxes. This is not an all encompassing list given the variations of complexity on each individual’s taxes.

IT IS POSSIBLE TO

ENJOY STRESS FREE HOLIDAYS THIS YEAR!

The holiday season can be downright exhausting. We have too many things to do and not enough time to get them done. The 2024 HOLIDAY PLANNER will not only help you get organized, but will also help melt away that holiday stress so that you can actually enjoy the season!

Tax Prep List will not email. It only goes to 50% and does not send. Please send me a copy to kikidoestaxes@gmail.com Thank you, Kiwana

Please email tax doc list copy to gregrajeneane@gmail.com

It should have hit your inbox, Gregra!

Could you please email the tax list to mmrfp@hotmail.com

Looks like this got safely delivered to you inbox!

Mine was never emailed – could you please email mine to alisamacquinn@gmail.com Thank you!

Sent it your way!

The link for the checklist is not working. Could you send me the tax checklist?

It would be greatly appreciated.

Disregard. It finally worked and I was able to download it. Thank you anyways!

Please send me tax list

Tax Prep List will not email. It only goes to 50% and does not send. Please send me a copy to kikidoestaxes@gmail.com Thank you, Brenda