Mini Budget Binder | Free Printable Download

Finances are hard. They are part of our everyday life and there’s no avoiding it. Most everything we do revolves around money in some way, shape or form.

Many people chose to avoid conversations with their spouses or family about money, because it’s simply easier not to. They push all their fears and frustrations to the back of their minds if they can avoid any money talk. In reality, it simply makes dealing with money harder and the spending problem bigger.

If fact, we need to do the complete opposite when it comes to money. It needs to be at the forefront of our minds and our conversations with our spouse or with ourselves. You see, you will never get ahead if you are not tracking, monitoring and saving each and every week.

There’s no better way to get started than by writing it all down. Wait, what? You’ve heard it all before, but you don’t have time for it, right? Let me tell you, it takes just a short bit of time and will make all the world of difference in your current and future financial situation.

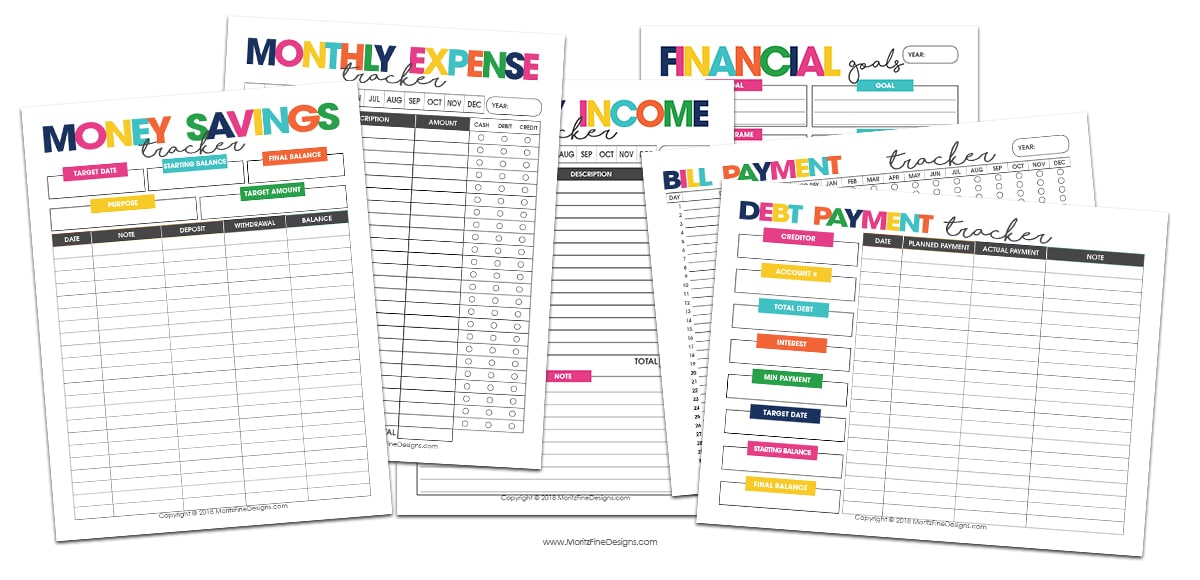

Mini Budget Binder

Let’s get started with the Mini Budget Binder. Grab the download for the free budget binder at the bottom of this post and follow the simple steps below.

1. Set Your Financial Goals:

Pick 1-2 or even a few more goals for your year. Write them down and give yourself a timeframe to meet the goals. Also take a few minutes to write out some steps you can in order to reach your goals.

One word of advice when it comes to goal setting. Think Big. Now is the time to stretch yourself. If you don’t write a big goal down, you will never try to reach it.

2. Track Your Monthly Income:

Write down every nickel, dime and dollar you earn during the month. It sounds silly, right? But it’s not. Of course there is your salary, but what about beyond that? Did your neighbors give you $20 for taking care of their dog for the weekend? Write it down. Did you sell a few personal items on Craig’s List or in the Facebook Marketplace? Write it down.

3. Keep Track of Your Expenses:

Keep every receipt and bill and, once again, write them down! Don’t just focus on the $200 electric bill and the $40 water bill–you know the normal monthly homeowner expenses, but where we lose track of a lot of our money each month are from the incidental expenses. So, the Starbucks runs, the shirt you picked up at Target, the ticket to watch your kid’s play their high school basketball game–they all need to be tracked.

After starting to track all of the smaller items, you will get a bigger picture of how much money you are actually spending on coffee each month, or how many things you just happen to “grab” at Target. It won’t take long before you realize where you need to cut back.

4. Set Your Savings Goals:

Every single person needs to have one savings goal, if not more. It could be to save for college or a car or a house or even for a vacation. Here’s my tip in regards to savings–pay yourself first! What exactly does that mean? Before you pay for all those incidental expenses each month, pay your savings account. If you make saving a low priority, you will never, ever save! After you pay your savings account and then the “normal” monthly expenses (such as mortgage, insurance, etc.) you will then see how much you have left for incidentals. It may mean a few less trips to Target each month, but you’ll be so glad when you walk in to the car dealership and can pay cash for your car!

We use the best app ever to help with our savings goals. It’s called Digit. It was so simple to set up. What it does is allow you to save for one or many goals. It connects to your bank account and every day or two pulls out a few dollars to put towards your goals. It takes small amounts frequently so that you don’t feel the pain of “losing” a huge to a savings account you told yourself you wouldn’t touch.

Let’s compare it to going through the Starbucks drive through every day. You feel like it doesn’t really impact your bank account. But let’s do the math $4 x 30 days=$120. What if Digit grabbed $4 from your account each day? Wow! It adds up quickly! If you want to give Digit a try, you get $5 to get started!!

5. Pay Down Your Debt:

Try to eliminate as much debt as you can as fast as you can. Always start paying off the loan or credit card bills with the highest interest first. Again, pay this monthly before you allow yourself to have “fun” money. Debt pay-off needs to be your top priority!

When you write everything down–daily, weekly, monthly–you will quickly come to the realization that finances don’t have to be something you don’t want to talk about. Instead the more you talk about it and make good choices with your money, the less worry there is.

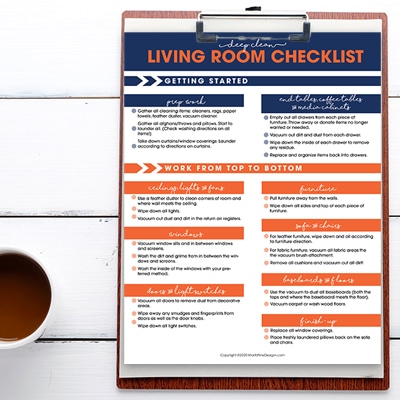

IT IS POSSIBLE TO

ENJOY STRESS FREE HOLIDAYS THIS YEAR!

The holiday season can be downright exhausting. We have too many things to do and not enough time to get them done. The 2024 HOLIDAY PLANNER will not only help you get organized, but will also help melt away that holiday stress so that you can actually enjoy the season!

This is super cute. Much appreciated for my 2019 money goals!! Woot Woot! Thank you!

You’re welcome, Stephanie!! Thanks for stopping by the blog!

Not receiving my mini budget printable

I love all of your printables! This year I have resolved to set a time frame to pay off all of my debt. Every extra penny will be going towards that. This is so helpful! Thank you for all of your blogs. I love reading from you every week!

What a great year it will be to have that debt paid off! Good luck–you’ve got this!

I have tried to download this several times (I really like all your products) and for some reason, it’s the only one that never works! 🙁

Sent! 🙂

What is the size of this mini planner? I use the Arc jr and wondered if it would fit in it. 8.5×5.5

The actual planner is 8.5×11″. It’s simply called the Mini Budget Binder, but not due to the overall size 🙂

I receive your emails a lot and came across the one to print off the budget binder. But I am not able to download it, tried registering with a different email and have not received anything either.

It looks like download you requested was delivered. Sometimes you just have to wait a bit for delivery :).

Hello,

I love your ideas and the tools… I keep trying to download these free printables but have yet to get them… Please help.

Thank you,

Patty

I’ve been trying to download this for a week and no matter how many times I put in my email address I never get the email to download it. What could be wrong?

I just sent it your way, Teresa!

The link to download the budget is not going anywhere, not able to get the free download

You most likely need to turn off your pop-up blocker! I did send the binder your way via email.

Requested this but it’s not arriving. Received the family goals & the goal setting mini guide though.

Sent your way!

It would not let me click on the link.

I’ve been trying for days to get this, but it never gets emailed to me…can you please help me???

Well shoot, Wendy! It looks like you downloaded it in 2020, and our system will only email it to you one time (which is why I created the Printable Resource Vault–so you have unlimited access to all printables). I’ll shoot you an email with the download.

Hi,

This is my second time applying for the mini budget tracker. It never came. Can I please have it? Thanks.

This was delivered on Jan. 30 :). That means it’s probably in your spam box. Can you check there for it?

Thank you so much for your colorful, free, budget printables!

Hi, I would love to have this mini budget printable, I already subscribe but received a different sheet.

I can not get the mini budget to download. Is there a special way?

Are you getting the pop up to fill out your name and email for delivery? If not, please turn off your pop up blocker and it should work fine!